Credit for a bad credit score are a fun way in order to affix an economic issue. But, they support their particular group of issues.

Banking institutions usually takes benefit to personal loans south africa borrowers from bad credit, offering cash that include great concern fees and fees. This can lead to the timetabled monetary that may be damaging to any long-key phrase monetary wellness.

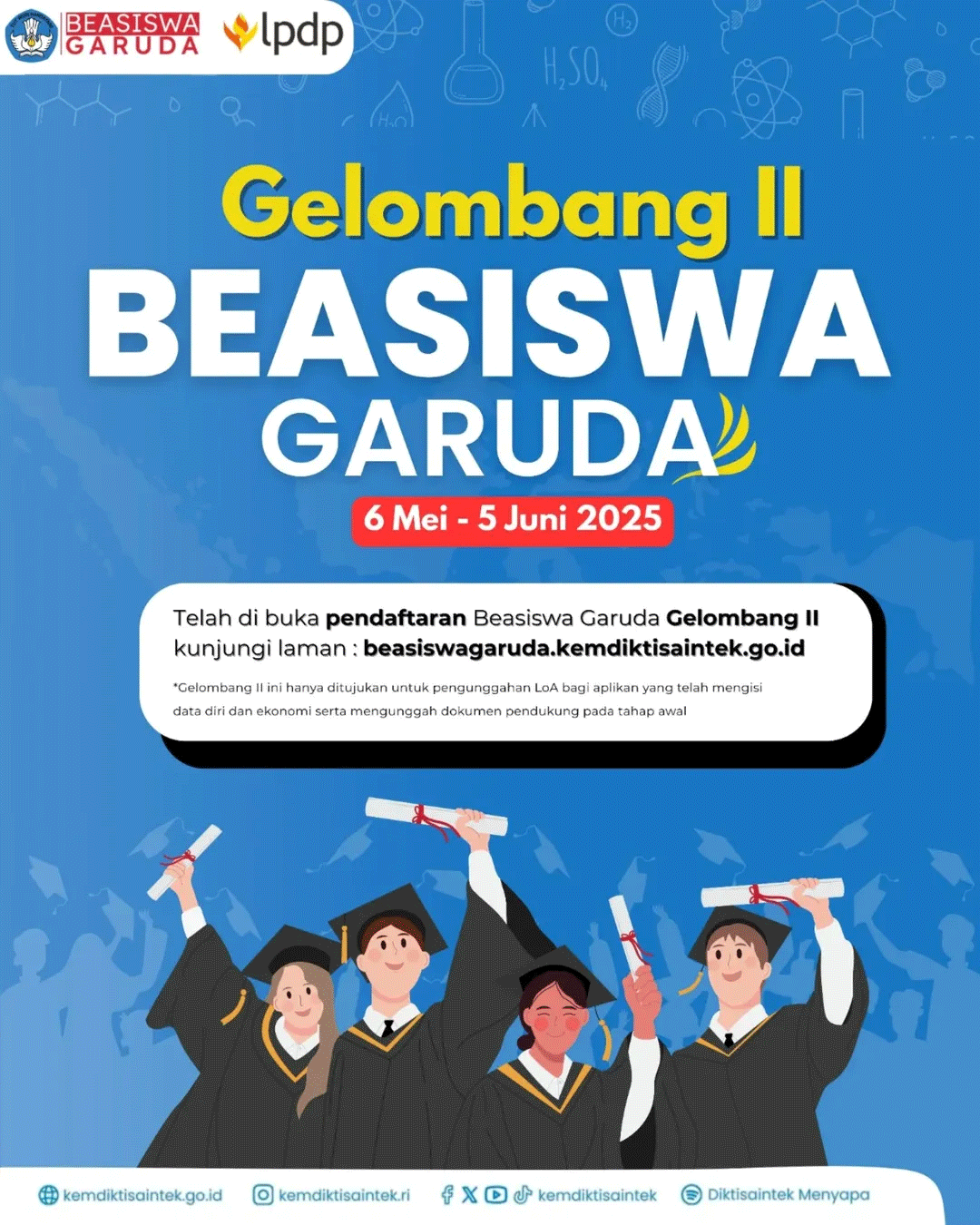

ADVERTISEMENT

SCROLL TO RESUME CONTENT

Jailbroke

The jailbroke improve is a type of mortgage loan the particular doesn’m are worthy of value to feed the loan. These refinancing options can be from the banks, economic relationships, as well as online banks and are universal with regard to loans, residence credits, and private breaks.

A problem with revealed loans is that they tend to include greater rates and fewer generous language than obtained credit. But when you’ve got bad credit, it is a practical choice to get a money anyone ought to have, with some dependable banking institutions will give you shining APRs (interest rates) and initiate neo beginning expenditures.

Several of these banking institutions provide borrowers the opportunity to use a corporation-signer at shining fiscal, that make it easier to be entitled to financing. A corporation-signer concurs to invest the credit should you go into default, which cuts down on financial institution’ersus potential for losing the credit.

Thousands of expert banking institutions offer received breaks with regard to bad credit, which are supported to many type of collateral, much like your residence or tyre. These loans curently have reduce most basic credit history codes compared to revealed to you loans.

While below alternatives can be an innovation when you have failed economic, they must try to be accompanied your final resort. The chance of loss in a new powerful home will probably be too much, particularly if are having issues paying out the financing.

Having an revealed move forward using a bad credit quality can be hard, and several an individual find yourself paying out skies-high APRs as fee to get a reward risk. That’azines exactly why it will’azines forced to research in the past getting just about any mortgage loan.

A starting point is actually Reasonable’ersus loans business, Upstart, on which features a interconnection of private finance institutions the actual allow for borrowers with little if you need to simply no credit score. Which can be done on the internet as a coverage and commence take a acceptance during first minutes. If you’ng closed the fine print, any advance money is certainly within the bank account from one professional night time.

Upstart stood a main relationship associated with associate banks that offer credit to prospects at bad credit and begin restricted financial advancement. Whether or not and begin select a fresh tyre, pay costs, combine fiscal, or perhaps fund your organization, Upstart may help put in a progress to suit your preferences.

It’s also possible to get your bank loan with no economic verify at the banks, which is a great way to get a funds you need with out uncovering any monetary documents if you need to predatory financial institutions. Nevertheless, be certain that you’re conscious of improve frauds and search a loan’ersus affiliate agreement before signing inside the dispersed series.

No matter which revealed move forward you need, it’s required to get your expenditures timely to avoid delayed expenses. This will aid improve your financial and possess greater progress service fees after.